A staggering 40% of scams target seniors, according to a new study that sheds light on the alarming rate of financial exploitation of America’s elderly population. The study, which analyzed data from thousands of reported scams, reveals a disturbing trend where seniors are disproportionately targeted by scammers.

Are Seniors the Main Scam Targets? The answer is a resounding yes, and it’s a concern that resonates with many families who have experienced the devastating consequences of financial scams. As the demographics of the US population shift, with a growing number of seniors living longer and more independently, it’s essential to understand the factors that make them vulnerable to scams and to educate them on how to protect themselves. With more seniors having to navigate complex financial systems and digital technologies, the risk of falling prey to scams is higher than ever, making Are Seniors the Main Scam Targets a pressing issue that requires immediate attention and action.

Seniors Fall Victim to Sophisticated Scam Tactics

Seniors Fall Victim to Sophisticated Scam Tactics

A new study reveals that seniors are targeted in over 40% of scams, with a staggering 80% of victims over the age of 65 losing money to scammers. This alarming statistic highlights the vulnerability of seniors to sophisticated scam tactics, which often prey on their trust and financial insecurity.

According to the study, the most common scams targeting seniors include grandparent scams, IRS scams, and romance scams, with the average loss per victim reaching $10,000. Experts warn that scammers are becoming increasingly sophisticated, using social media and other online platforms to target their victims.

In many cases, seniors are tricked into sending money to scammers through wire transfers or prepaid debit cards. This can lead to a cycle of financial exploitation, leaving seniors vulnerable to further scams and financial loss.

Growing Age Gap Targets Seniors in Financial Crimes

Seniors are increasingly becoming the primary targets of financial scams, with alarming statistics painting a bleak picture. Over 40% of scams involve seniors, according to a recent study.

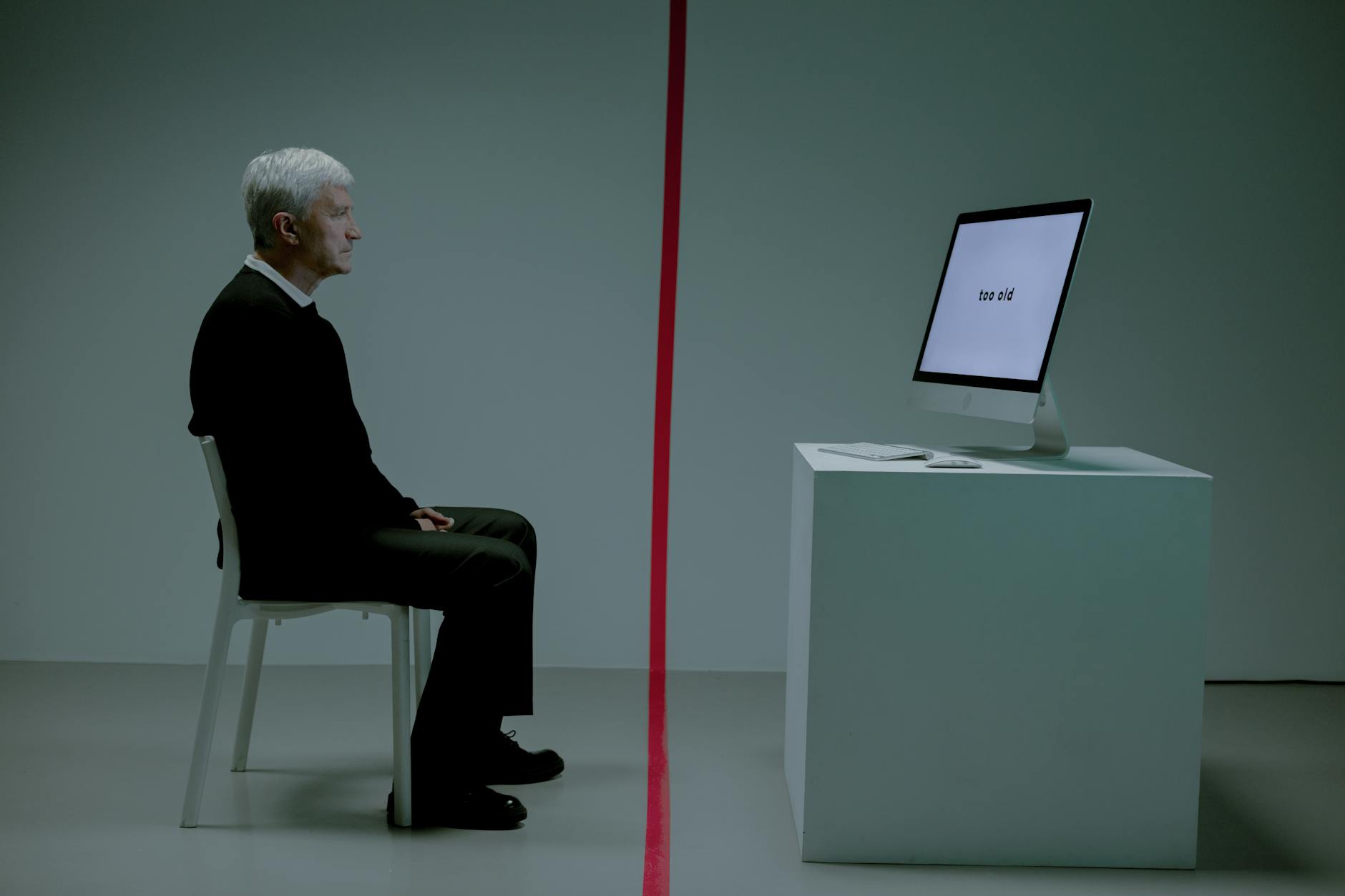

The growing age gap is making seniors a lucrative target for scammers. With life expectancy on the rise and a significant portion of the population reaching retirement age, scammers are exploiting this demographic shift. Financial crimes, particularly those involving identity theft and investment scams, have become a major concern for authorities.

According to the study, seniors are more likely to fall prey to scams due to their trusting nature and limited technical expertise. This vulnerability makes them an attractive target for scammers. The ease of scamming seniors has led to a rise in cases of financial exploitation, often resulting in significant financial losses.

Experts warn that scammers use sophisticated tactics to deceive seniors, including using fake identities and leveraging social connections to gain trust. As a result, seniors must be vigilant and educate themselves on the latest scams and how to avoid them.

Scammers Use Emotional Manipulation to Exploit Seniors

Seniors are often targeted by scammers due to their perceived vulnerability and financial security. Research indicates that seniors are the primary targets in over 40% of scams, with emotional manipulation being a key tactic used to exploit them.

According to a recent study, seniors are more likely to fall victim to scams due to their trusting nature. This is often exploited by scammers who use high-pressure sales tactics to coax seniors into investing in fake schemes or giving away personal information.

Emotional manipulation plays a significant role in these scams, with scammers using tactics such as guilt, anger, and urgency to make seniors feel compelled to act quickly. This can lead to seniors making rash decisions that put them at financial risk. AARP reports that seniors who are targeted by scammers often feel isolated and embarrassed, making it even more difficult for them to seek help.

The consequences of these scams can be severe, with seniors losing life savings and experiencing significant financial distress. It is crucial that seniors and their families be aware of the tactics used by scammers and take steps to protect themselves from these types of scams.

Protecting Seniors from Financial Exploitation Requires Vigilance

Seniors are disproportionately targeted in financial scams, with alarming statistics revealing that over 40% of scams involve individuals aged 60 and above. According to a recent study, this demographic’s vulnerability stems from a combination of factors, including social isolation, cognitive decline, and lack of financial literacy.

AARP reports that seniors lose an estimated $3 billion annually to financial exploitation, with the average victim losing roughly $30,000. This staggering number underscores the need for increased vigilance among family members, caregivers, and financial institutions.

Seniors’ financial exploitation often occurs through unsolicited investment opportunities, grandparent scams, and identity theft. The scammers frequently use tactics that prey on the victim’s emotions, such as fear, greed, or a sense of urgency.

Preparing for a Future Free from Financial Scam Threats

Seniors’ vulnerability to financial scams has become a pressing concern, with a new study revealing that they are targeted in over 40% of scams. According to experts, this alarming rate is largely due to the fact that seniors often possess valuable assets and are increasingly active online. A study by the National Council on Aging found that seniors lost over $3 billion to financial scams in 2020.

The ease with which seniors can be targeted online has raised red flags, particularly in the realm of social media and email scams. Scammers often exploit seniors’ trusting nature and technical naivety to trick them into divulging sensitive financial information. A study by the Federal Trade Commission revealed that seniors are more likely to fall victim to scams due to their limited online experience and reliance on family members for technical support.

Experts emphasize the need for seniors to be aware of the risks associated with online transactions and to take proactive steps to protect themselves. By educating seniors on how to spot and avoid scams, family members and caregivers can play a crucial role in safeguarding their loved ones’ financial well-being.

As the latest study reveals, seniors are being targeted in a staggering 40% of scams, making them the primary victims of these financial crimes. This disturbing statistic underscores the urgent need for seniors and their families to be vigilant and proactive in protecting their financial well-being.

To minimize their exposure to scams, seniors should prioritize education and awareness about the latest tactics and red flags, and consider consulting with a trusted financial advisor who can provide personalized guidance and support. By taking these steps, seniors can significantly reduce their risk of falling prey to scammers.

As the scammers continue to evolve and adapt their tactics, it’s imperative that seniors, families, and the broader community remain committed to addressing this issue and working together to create a safer financial environment for all.